This repository provides a collection of hands-on tutorials for the FinRL ecosystem, a deep reinforcement learning (DRL) framework designed to automate trading in quantitative finance.

Mission: To create hundreds of user-friendly demos that help users apply deep reinforcement learning to financial tasks.

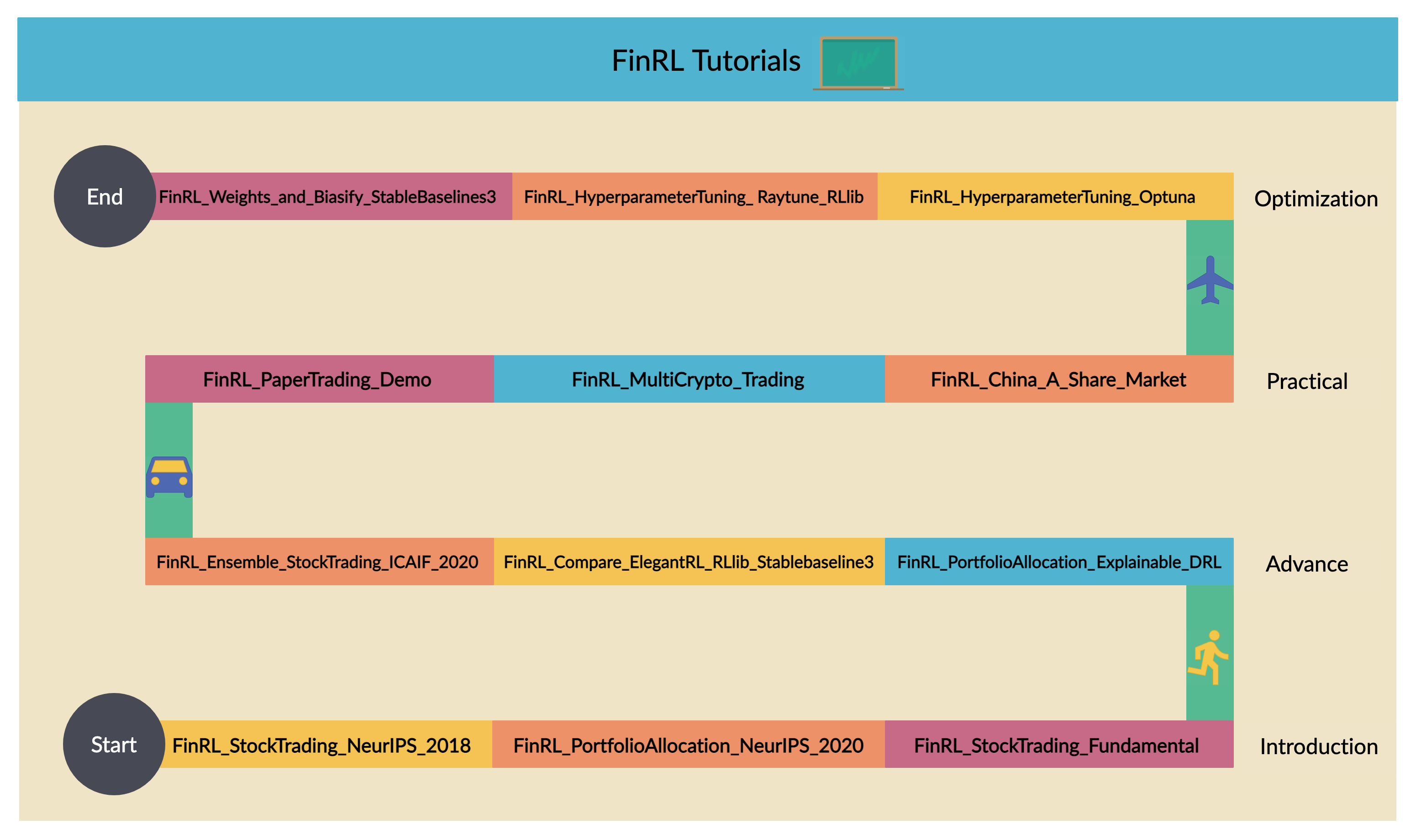

FinRL is a framework that provides a full pipeline for developing and testing DRL-based trading strategies. These tutorials are designed to guide you through the process, from basic introductions to advanced applications and practical implementations.

Note that we provide tutorials for FinRL-meta and FinRL.

notebooks for beginners, introduction step-by-step

- FinRL_StockTrading_NeurIPS_2018: first tutorial notebook that trades Dow 30 using 5 DRL algorithms.

- FinRL_PortfolioAllocation_NeurIPS_2020: provides basic settings to do portfolio allocation on Dow 30.

- FinRL_StockTrading_Fundamental: merges fundamental indicators in earnings reports such as 'ROA', 'ROE', 'PE' with technical indicators.

notebooks for intermediate users

- FinRL_PortfolioAllocation_Explainable_DRL: this notebook uses an empirical approach to explain the strategies of DRL agents for the portfolio management task. 1) it uses feature weights of a trained DRL agent, 2) histogram of correlation coefficient, 3) Z-statistics to explain the strategies.

- FinRL_Compare_ElegantRL_RLlib_Stablebaseline3: compares popular DRL libraries, namely ElegantRL, RLlib and Stablebaseline3.

- FinRL_Ensemble_StockTrading_ICAIF_2020: uses an ensemble strategy to combine multiple DRL agents to form an adaptive one to improve the robustness.

notebooks for users to explore paper trading and more financial markets

- FinRL_PaperTrading_Demo: paper trading using FinRL through Alpaca.

- FinRL_MultiCrypto_Trading: trading top 10 market cap cryptocurrencies.

- FinRL_China_A_Share_Market: trading on China A Share market.

notebooks for users interested in hyperparameter optimizations

other related notebooks

This is an open-source project that thrives on community contributions. We welcome you to get involved!

- Contribution Guidelines: Learn how to contribute, our guiding principles, and PR guidelines.

- File an Issue: If you see something, say something!

For those who want to dive deeper into the theory and research behind financial reinforcement learning, we maintain curated lists of resources:

- Awesome FinRL: A curated list of awesome deep reinforcement learning strategies, tools, and resources for finance.

- FinRL Papers: A list of academic papers from the AI4Finance community and the Columbia research team.